Community House

Project Dashboard

1/18/24

Project Completed

Refugees Settled to Date

%

Project Completion

Get Project Updates

Community – First Family Arrival

Family ARRIVAL

We’re excited to announce that rehab is officially complete and our first family has moved in. We were actually able to move the family in prior to the finishing touches of rehab.

The family is from Afghanistan with three adult sons. The parents speak little English, but the sons are able to speak fairly well. The family was matched to our impact home through the help of Nationalities Services Center (NSC), one of our well established partners.

The family is settling nicely and getting oriented to the area. NSC will be working with them to find work and adjust to the local customs.

REHAB COMPLETE

In other news, we’ve finally completed our rehab, including repairing a water main under the sidewalk. While the water main was a large repair, we were able to make the fix quickly.

Other minor repairs which were noticed after the major rehab was complete have also been taken care of at this point and the house is in excellent condition.

What’s Next?

Remember back in the beginning when we mentioned that only a portion of the cash needed to purchase and rehab the property needs to be fundraised? Well that is because we use some special financing to get access to short term funds that allow us to purchase the property with cash. Now that the property is fully rehabbed and rented, we need to refinance the property by opening a mortgage.

Why get a mortgage now? If we had gotten a mortgage when we first purchased the property, then we would have been able to get a loan for 75-80% of the purchase price of the house. That means we would have had to put down 20-25% of the purchase price in cash as a down payment. Afterwards, however, we would have had to pay for all of the upgrades and repairs in cash.

The significant cost in repairs and upgrades, however, have now raised the value of the home by at least that amount. So when we refinance and open a mortgage on the property now, we will be able to get a loan for 75-80% of the new home value. This value is called the after repair value (or ARV) and is significantly higher than the initial purchase price of the property.

When we open the mortgage, the bank will give us cash for the value of the mortgage. And this cash will allow us to pay off the initial short term loan we opened to make a cash offer on the property.

Confused yet? If so, don’t worry about it. Just know that by waiting until now to get the mortgage, we will have saved about $30,000 for a fully refurbished house. And that savings gets us that much closer to the next impact home.

Community – Rehab Complete

Rehab Complete

We are happy to announce that rehab is just about complete for Community House. Work involved replacing flooring, kitchen upgrades, new appliances, painting, electrical work, and various smaller repairs. The basement is large and partially finished to make it a more useable space.

360 WALKTHROUGH

Using the walkthrough below, you can take a tour of the home. Click along the floor to travel to different sections of the house.

Remaining Work

As we were nearing completion, a small leak was noted in the basement. After some investigation, it turns out the leak is coming from the water main leading to the house from the street. Unfortunately, as some of you home owners may know, even though the leak is outside the house, it is still the responsibility of the homeowner.

We have a professional team scheduled to dig up the sidewalk, repair the leak, and repave the area in the next few days. Believe it or not, they expect the entire job to take just a single day.

Once that final repair is complete, the house will be fully complete!

What’s Next?

We already have a family identified through one of our resettlement partners and they should be settling in shortly. We are also beginning the refinance process to obtain a mortgage. As you might recall, we use some advanced financing strategies to purchase the house in cash and complete the rehab. Once everything is fully complete, we work with a lender to obtain a mortgage in order to get about 75% of the invested cash back out of the property.

Community – Settlement

Settlement

It’s official! Community House now belongs to Compound Impact. Settlement passed without a hitch thanks to our fantastic realtor Yuriy, from TrustArt Realty. Now on to the fun part…

With keys in hand, it’s time to get right to work on the rehab so we can get a refugee family placed as soon as possible. Not only do we want to get a family into a safe home as soon as possible, but every week that the house is not rented is another week of expenses without income.

The contractors were able to walk through the property before settlement and develop a full scope of work for the repairs needed. A scope of work is a contractor term for a detailed list of all the work that needs to be completed on a given project. In total, repairs and upgrades for Foundation House are projected to cost between $25,000 and $30,000.

What’s Next?

It’s rehab time. Our general contractor will be bringing in a number of subcontractors to complete a variety of upgrades and repairs over the next few weeks to get the house into top shape before move in day. At the moment, we are aiming to have a family placed in the September timeframe.

With a move-in day set, we will also begin to work with the resettlement agencies to match a family to our impact home. With 3 bedrooms, the most likely match will be a larger family with several kids.

Community – Under Contract

Under Contract

Just a few days ago we managed to get a house under contract! The house is less than 3 blocks from our very first home, Foundation House. It was listed as Coming Soon on the MLS, but our realtor reached out to get a feel for things.

We had been targeting the same area as Foundation House in order to try to create a cluster of impact homes, and this property is only a short walk away. The proximity will be helpful in allowing us to build inter-family community over time.

After some back and forth discussion prior to listing, we were able to get an offer in the second it hit the market, and the seller accepted the offer shortly after.

The house is a 3 bedroom, 2 bathroom row home with a finished basement. Much of the home had just been upgraded, including the roof, first floor, and a round of paint. It will require a new boiler for heating as well as a hot water heater, but most of the homes in this area require those upgrades due to their similar age.

Our offer included an inspection contingency (meaning we can back out of the deal if an inspection turns up issues that we are concerned about).

| Title | Address | Description |

|---|

Paying in cash

One of our key purchase strategies is paying for houses in cash. When anyone makes an offer on a house, and that offer is accepted, the house is considered “under contract”. The sale of the property has not occured, but the contract is an agreement between the seller and buyer that the sale will occur on a future date (called the settlement date).

While the house is under contract, there are a number of ways that the deal can fall through. For example, there is often an official inspection of the home by a licensed inspector. If there are any serious concerns, the buyer can leave the agreement and have their initial deposit returned. This is called an “inspection contingency”.

Another common contingency is a financing contingency in which the buyer can back out of the deal if they are not able to secure a mortgage for the property. Many deals fall through this way. However, if the buyer is going to pay in “cash”, meaning they are not going to be getting a mortgage from a lender, then the seller does not have to worry about the financing falling through at the last minute.

For this reason, buyers (like Compound Impact) who are able to pay “cash” for a property have a significant advantage over another buyer who will need a mortgage to purchase the property.

We do not fundraise the entire purchase price before purchasing a property. Instead, we fundraise about 35% of the property and rehab cossts and use a short term loan (which last only a few months) to obtain the remainder of the “cash” needed to purchase the property.

These type of loans are provided by a special group of Compound Impact supporters called our Bridge Team. These generous individuals provide loans for 4-8 months at 0% interest to Compound Impact to allow us to take advantage of these specialized techniques.

What happens in a few months? Don’t worry, we’ll get to that soon!

What’s Next?

In a few weeks, we’ll move on to settlement, at which point the official sale of the property will occur. In the meantime, we’ll be working closely with our contractors to be ready to launch into the rehab as soon as the property is ours.

Community – House Search

House Search

We are excited to announce that we have completed our fundraising and are currently looking at a number of potential properties. The property selection process is one of the most important steps in the process. Purchasing a house for the wrong price can end up costing thousands of dollars, so it’s important to get right. And making an offer too low can lose a potentially great deal.

What to Look For

When we look for new properties, we look at many factors. But there are a couple that stand out.

Purchase Price: The purchase price is one of the most important factors, but the list price is not always the final answer. We often bid under asking price, though some properties may sell for even more than the list price.

Work Needed: We always look for houses that need significant about of work done. This is an important part of our model, and ultimately allows us to buy houses much cheaper than they are worth. The more the house needs work, the lower the price we can get.

Cost of Rehab: We always make an estimate of how much the rehab of a house will cost. We are able to make our estimates using experience and our highly qualified team of contractors who will often walk-through a house before we even make an offer. This process helps us make accurate projections.

Market Rents: All of our refugee families pay normal rent rates for our impact homes. It is important to remember that refugee families aren’t in need of discounted housing, but rather of fair and accessible housing. Rent is determined by the current rates of nearby similar properties and is an important factor in our financial analysis.

We are currently looking in the NE Philadelphia neighborhoods of Tacony, Mayfair, and Oxford Circle. These neighborhoods are home to many successfully integrated Eastern European refugee families as well as Syrian and Afghan communities. All of our existing properties to date are in this immediate vacinity.

| Title | Address | Description |

|---|

What’s Next?

We are continuing to search for the right property. When we find a good fit, we make an offer immediately. It is not uncommon to have to make several offers before we get a property under contract.

Community – Initial Launch

A BOLD VISION

Our next project will be a single-family home in Philadelphia similar to our prior projects. We are seeking to raise $180,000 to fully cover 100% of the purchase and rehab of this home in cash without any financing or mortgage.

Once the project is complete, the house will be refinanced to pull out about $120,000. These funds will be used for down payments on two additional properties for a total of 3 homes.

Why not just raise enough for a down payment? Compound Impact has undergone a change in legal structure as we have more formally become a nonprofit organization. Because of this legal structure, we will need to own the first house outright before obtaining a mortgage (refinancing).

SO WHAT’S THE COMPOUND IMPACT?

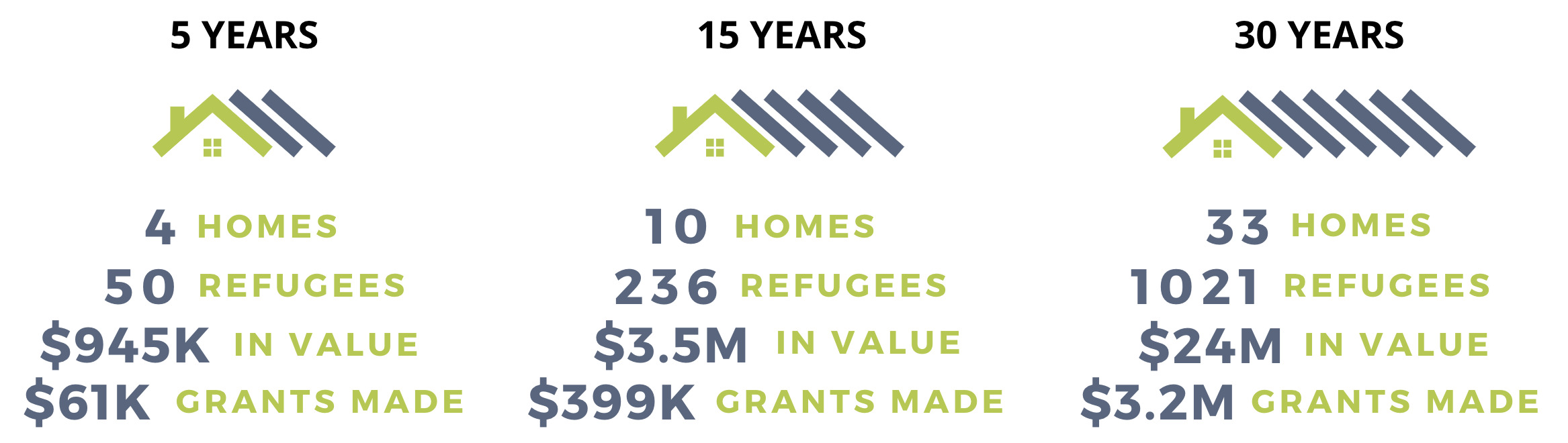

Over time, all rental income profit will be used to support global missions abroad. Every 5 years, we will refinance the properties to access some of the equity value that has built up. These additional funds will be used to purchase additional properties which will be used in the same manner. Below are the projections for the impact of the original $180,000 based on the real results from our previous experience.

**Results based on assumptions that all built equity is used to purchase additional properties every 5 years, average family size is 5 people, and average length of stay is 1.5 years (though families may stay as long as they wish). Total property value refers to appraised value rather than equity.

These estimates are in line with the real results we have seen with our existing units. And it is important to note that this impact requires only a one time fundraising goal of $180,000 without any need for ongoing donations.

How are those gains possible? Many people are achieving these types of gains in their own personal real estate portfolios through careful property selection, experienced negotiation, and strategic value-addition with property rehab. We employ many of these same strategies. However, rather than personal wealth-building, our goals are standing beside our underserved refugee families and channeling global impact through grant-making.

Do you provide discounted rent? The number one issue for our refugee families is not that they are unable to pay for rent, but that no one will rent to them. Landlords typically require a background check, credit history, rental history, and proof of income, none of which a newly arrived refugee can provide. We make all of our homes available to this population that historically struggles significantly to find housing.

How involved is Compound Impact with the families? We have contact with every family to ensure that they are safely transitioned to their new home (often directly from the airport). However, we also partner with the 3 major refugee resettlement agencies in Philadelphia to navigate each family through the initial adjustment including orientation to the area, language-learning, finding employment, and navigating the school system.

What about maintenance costs? Before we purchase any property, we do an extensive analysis to ensure that the monthly rental income will be sufficient to cover all costs including the mortgage, taxes, insurance, monthly maintenance and repairs, and property management. Every property generates a profit even after these costs are accounted for, and this profit is used to make grants to other 501(c)3 charities working globally.

Will You Join Our Team?

We are excited to launch our next project and to multiply the impact over the years. And we are looking for a team to support us in raising this initial launch funding.

We are already $21,000 towards our $180,000 goal, but that means we still have a ways to go. Become one of our initial launch funders and watch your impact grow for decades!